m.Kids Capital Partners — Micro Private Equity

Invest in—or sell to—a platform professionalizing childcare in Poland. Dual track for Investors (LPs) and School Owners.

return (5 years)

For invest (LPs)

Invest in—or sell to—a platform professionalizing childcare in Poland. Dual track for invest (LPs) and School Owners.

$700K invested • $2M revenue • $300K EBITDA

Target 3x by 2031 (24% CAGR)

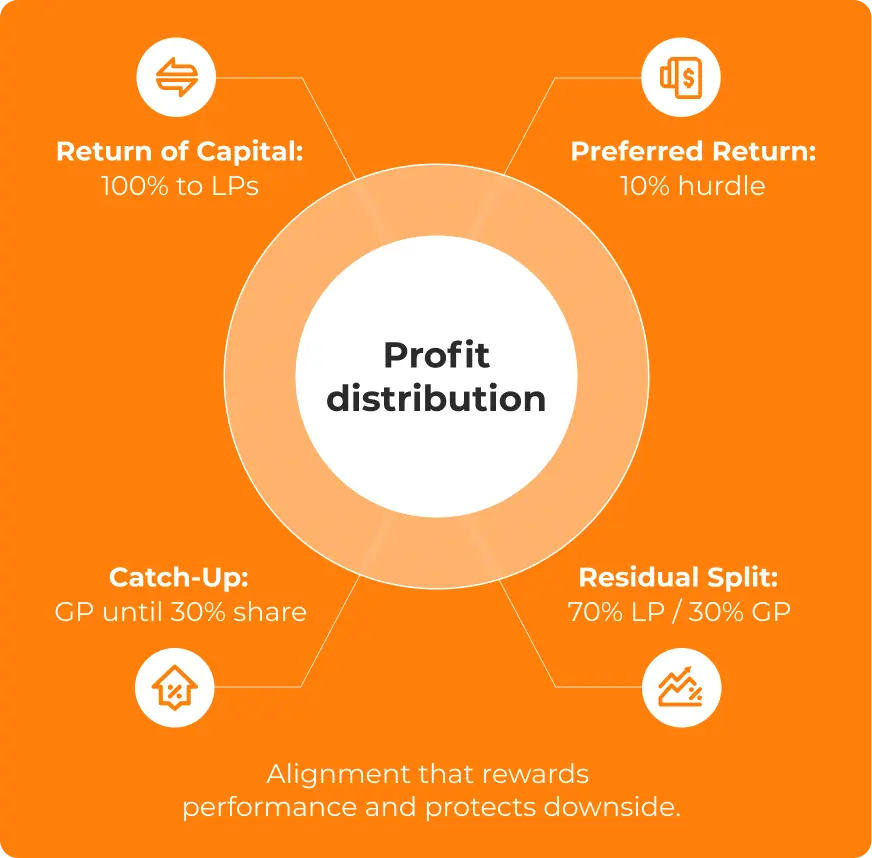

LP/GP alignment: 10% hurdle → GP catch-up to 30% → 70/30 residual

For Sellers / Partners (School Owners)

We buy, integrate, and professionalize while protecting your legacy and staff — with flexible deal structures.

Partial sale & stay:

continue operating within a larger chain, with an option to sell the remainder at a higher margin in ~5 years.

Full sale:

plan a new career or retire, with staff continuity and transition support.

Eligibility:

profitable last 3 years; all models (bilingual, Montessori, special needs) and all Poland regions welcome.

We’ve built:

childcare chains in Eastern Europe — full details on request.

Operational Proof

$700K invested • 4 schools integrated • $2M revenue • $300K EBITDA. Built systems that scale essential childcare services.

$700K Invested

$2M Revenue

$300K EBITDA

Why social infrastructure in Poland

Why social infrastructure in Poland

Macro FOMO

Nordic & US investors increasingly target social infrastructure for lower-volatility yield; Poland ranks among the fastest-growing large economies and Europe’s 5th by size.

Policy tailwinds

- Birth/family tax incentives (sometimes dubbed a “childless tax” in discourse)

- Nursery reimbursements; childcare subsidies covering a large share of revenues (~70% — verify)

- High defense & social spend supporting long-term demographic strategy

Nursery dynamics

Nordic & US investors increasingly target social infrastructure for lower-volatility yield; Poland ranks among the fastest-growing large economies and Europe’s 5th by size.

Structure & Returns

Institutional mechanics on a real-economy asset:

- GP manages the fund and controls 100% of the MC

- LPs provide capital with limited liability

- MC executes acquisitions and integration

General structure (GP)

Manages fund, controls MC

Limited structures (LPs)

Provide capital, limited liability

Management Company (MC)

Executes acquisitions & operations

Take the next step

- Investors: request the deck or book a call

- Sellers: request company profile + offer or get a valuation call